MoneyHash Sync

As online transactions rise, merchants struggle with managing payments through many providers. Manual reconciliation is time-consuming and error-prone, making accurate accounting a significant challenge. To help, MoneyHash introduces the Sync feature, connecting payment provider APIs and consolidating data into a centralized report. This simplifies reconciliation, providing a comprehensive transaction view, payment tracking, and accurate accounting.

Benefits

The Sync feature offers numerous benefits for your business, such as:

- Efficient Reconciliation: Streamlined and accurate reconciliation of online transactions.

- Ensure Data Security: Maintaining high data security levels and compliance with industry standards.

- Seamless Integration: Easy integration with payment providers.

How it works?

The MoneyHash Sync feature allows for seamless data synchronization. The process involves retrieving transaction data from various providers and consolidating it into a centralized report. The resulting report becomes a single source of truth for all transactions, offering merchants an efficient and accurate way to reconcile online payments.

Standardized report format

Despite the different standards that each payment provider may use, the MoneyHash Sync solution translates the information to a single format, making it easier for you, the merchant, to analyze data from several providers.

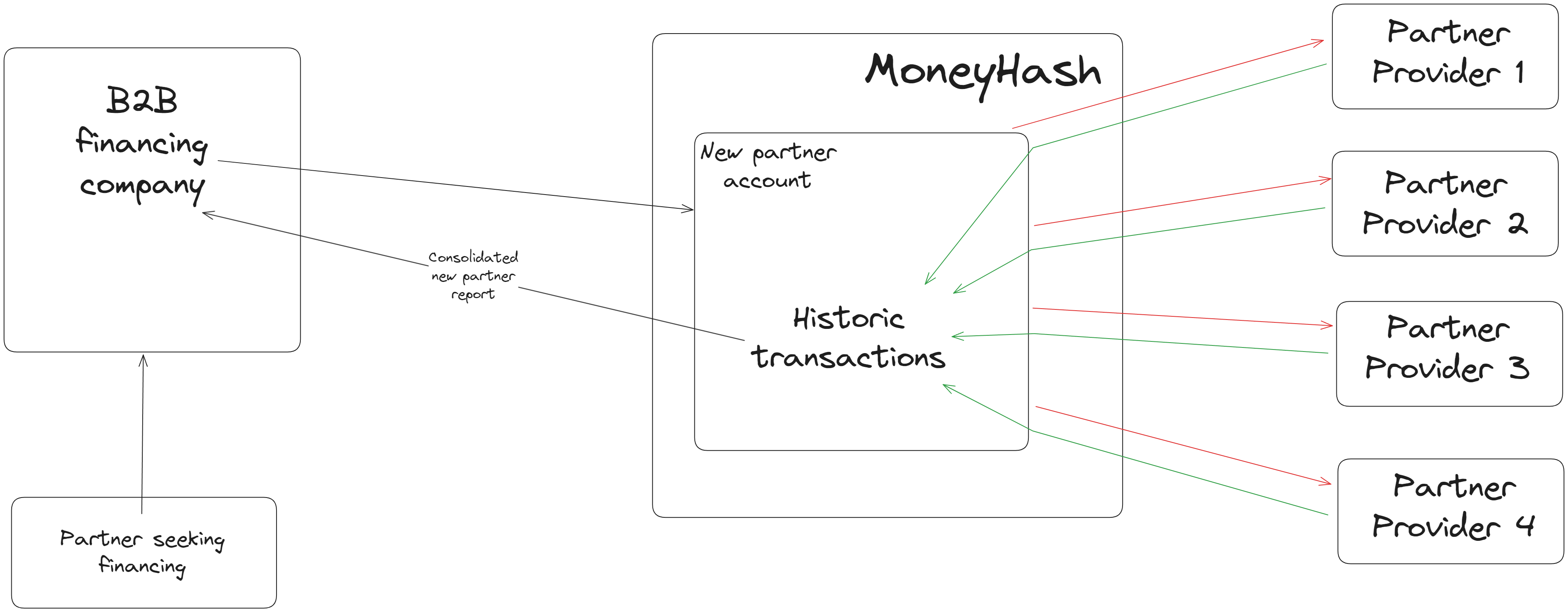

B2B financing example

MoneyHash Sync is often used by financing companies to evaluate their clients' creditworthiness. If a financing company wants to partner with a new client, it can utilize MoneyHash Sync to establish a connection with all the payment providers used by the client. This will help the financing company acquire accurate transaction data, enabling them to make informed decisions.

By utilizing the Sync feature, the financing company gains access to precise and reliable reports on the partner's past transactions from every provider. This ensures a complete and trustworthy data source, making the process more efficient and guaranteeing the accuracy and integrity of the historical transaction information. The following diagram illustrates this use case.

How to use MoneyHash's Sync

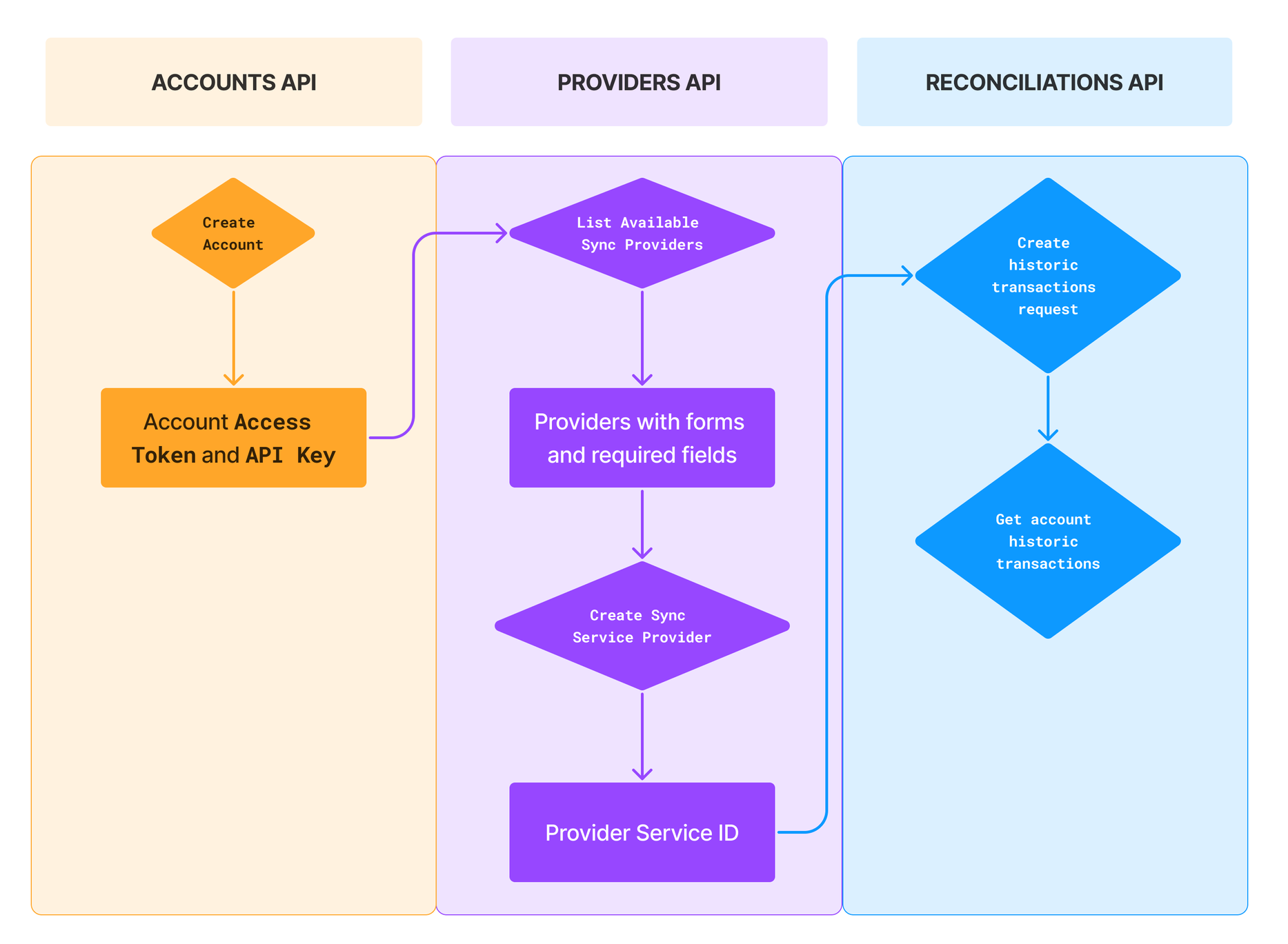

To use MoneyHash's Sync, integrating through API, you will need to create a new account within your organization and, using the Access Token and API key of this new account, connect to the Sync service of each provider you need transaction history from. After making said connections, you request that MoneyHash consolidate all transactions into a single report.

The steps below summarize the operation:

- Create a new account.

- Retrieve the Access Token and API Key.

- Use the retrieved data from step 2 to list available sync providers.

- Create a Sync service provider using the provider's

form_idfrom the request in step 3. - Create a historic transaction request.

The steps above are illustrated by the flow below:

Platform Connect Sync View

Organization admin can use the embed_url from the Platform Connect feature, adding a

mode=sync query parameter

to the url. This will show the providers that support Sync Provider, and you are able to make the connections

through this UI. This replaces steps 3 and 4 above.

By following the described steps, you will receive the historical transactions of the account, consolidated into a centralized report. This structured and standardized format, facilitated by MoneyHash's Sync, significantly simplifies data analysis. The standardized presentation enhances clarity, making it more straightforward to derive insights and draw meaningful conclusions from the transactional information.

Provider Sync API

MoneyHash's Provider Sync API provides endpoints to create a new sync provider connections, list available sync providers, and retrieve a sync service provider.

Create Sync Provider

API

Create a new sync provider connection.

List all available Sync Providers

API

List all available sync providers.

Retrieve a Sync Provider

API

Get the details from one sync providers.

Reconciliation API

MoneyHash's Reconciliation API gives you two endpoints, allowing you to create a new request for historical transactions and to filter the transactions from a report by the provider.

Create a Historical Transaction Request

API

Make the request to receive the historical transaction of an account.

Filter Account Historic Transaction by the Service Provider

API

List the historic transaction filtering by one provider.

Updated over 2 years ago